|

FREE GUIDE: HOW TO LAUNCH AN ONLINE PERSONAL TRAINING BUSINESS

IN JUST 7 DAYS

✓ The new, better way of launching an online business

✓ The fastest way to create in irresistible offer ✓ A simple system to sell to clients who are interested |

|

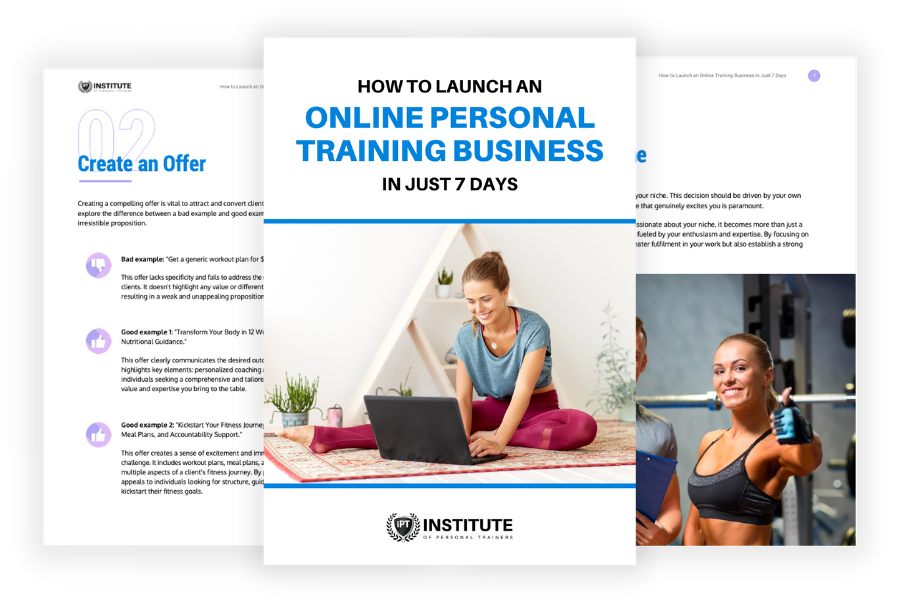

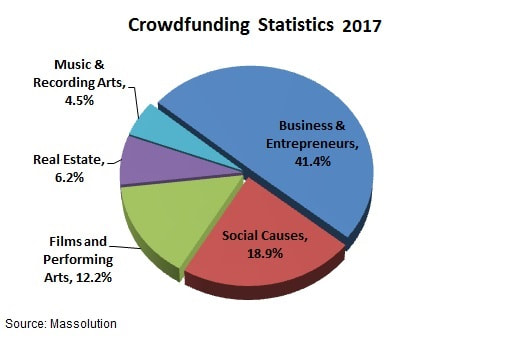

Finance is the lifeblood of any personal trainer business. Without it, you won’t be able to achieve your dream of starting a personal training studio, irrespective of talent and skill. Getting finance isn’t an easy job. The biggest challenge to funding your personal training studio is to find the right sources. To help make your work easy, we’ve listed the top 7 sources you can approach, to make your fitness facility dream a reality: Angel Investors Angel investors are highly successful businessmen and businesswomen who have a very high net worth, and who invest their personal earnings into promising startups. The idea behind angel networks is to support talented entrepreneurs to start their business. Finding out more about them and how they can help you fund your new personal training studio can be the key to your successful fitness venture. In exchange for their money, you’ll need to give a portion of equity (partial ownership of the business) or convertible debt (a debenture that can be converted into equity shares if the investor wants). Jeff Bezos of Amazon and Marissa Mayer of Yahoo! are two of the biggest angel investors in the world. Corporate Incubators and Accelerators Incubators are those businesses who provide finances and operational support to entrepreneurs to help get their business off the ground from as early stage as before the concept phase. So, say you plan to start a personal training studio but you haven't decided on your services structure, products, systems or even marketing launch strategy yet. These incubators will not only give you funding but they’ll also work with you to create your business idea, business model and plan, get the right space, equipment and the talent to set up your business. Once your personal training studio is off the ground, the incubators can connect you to accelerators to help you grow your business as fast as possible. Corporate incubators and accelerators can be considered as partners for your new fitness business, they actively work with you in every operational and strategic area to help you make your business decisions. Again, a portion of the profits or a share in the equity is what these firms expect in lieu of their investments. Crowdfunding Platforms Crowdfunding is a great way to get funds from the general public. According to Massolution's 2017 crowdfunding statistics 41.4% of all funds raised was granted to businesses and entrepreneurs. Getting funding for your personal trainer studio via a crowdfunding platform can be the next best business decision you make. All you need to do is log on to a crowdfunding platform, upload a detailed description of your fitness facility project, and add a business plan with realistic goals, profit expectations, and product/service description. If the other users on the platform like the idea behind the business, they can pledge a certain sum of money to you as a donation or pre-purchase your product/service. Crowdfunding is a great tool to not only finance your business but also market it. You can also gauge the public’s reaction to the business idea and identify whether the business will realistically work on the market or not. Kickstarter and Indiegogo are two prominent crowdfunding platforms. Venture Capitalists If you’ve already set up your personal training studio successfully, but are considering to grow your business by either opening a franchise, moving into a bigger space or serving significantly more clients, then approaching venture capitalists for help is a good choice. Venture Capitalists are similar to angel investors, however

VC’s buy a share of your business and will work with you to ensure your fitness venture is headed to the expected direction. After a period of time, once the desire ROI is achieved the VC will sell the shares back to you that can happen via an Initial Public Offering (IPO) if your business is ready to go public. The best advantage of using a Venture Capitalist is benefiting from their years of business experience. You can be sure that they’ll have experienced almost all kinds of business scenarios, making them the go-to-gurus for business advice. Bankers Traditional methods of financing, like banks, are another option that you can consider when funding your personal training studio. Bankers give loans to businesses on interest and if you fulfil certain mandated requirements, you may be eligible for interest deductions and business-friendly loans. To get your loan pre-approved by the bank, you’ll need to provide a detailed business plan and the relevant business registration documents, company prospectus, and other identification documents. The advantage of using banks for business funding is that they are a more stable and safer form of financing (since the interest rate remains the same throughout the cycle), but they can also be expensive because of the same high interest rates. Micro-Financiers Getting a bank loan is a challenging process. There are many statutory requirements that you’ll need to fulfil to be eligible. If you don’t wish to get entangled in long legal proceedings or you don’t qualify for a bank loan or funding from an investor, why not go the unconventional way and get funding from a Non-Banking Financial Corporation (NBFC)? NBFC’s specialize in micro financing and they usually lend to entrepreneurs and small business owners who have no money and who have a very limited access to bank loans. Of course, it is important to remember that although getting funds for your personal training studio is easier here, there are still some eligibility criteria that you need to fulfil to be eligible for the loan. Self-Funding If you have a sizeable saving to your name, then nothing beats self-funding your business. When you fund your own fitness facility, you don't need to worry about additional liabilities such as high-interest rates and longer loan repayment cycles plaguing you.

You will also retain control of your personal training business when you self-fund. Often, entrepreneurs who fail to pay back the funding on time, find their business being taken over by the investors themselves or an external company chosen by the them. You can avoid these problems by self-funding. But, realistically, not every personal trainer has the required money. In these cases, you can always approach your friends and family for help. After self-funding, friends and family is the next best thing. |

Our All In One Platform

Check out out all in one business & marketing platform for personal trainers!

WEBSITE BUILDER | FUNNELS |MEMBERSHIPS | SCHEDULING| EMAIL MARKETING| PAYMENTS| CRM | AI ASSISTANT | SURVEYS

Popular Articles

Trusted Partners

We work closely with some of the best service providers in the fitness industry.

Categories

All

|