|

FREE GUIDE: HOW TO LAUNCH AN ONLINE PERSONAL TRAINING BUSINESS

IN JUST 7 DAYS

✓ The new, better way of launching an online business

✓ The fastest way to create in irresistible offer ✓ A simple system to sell to clients who are interested |

|

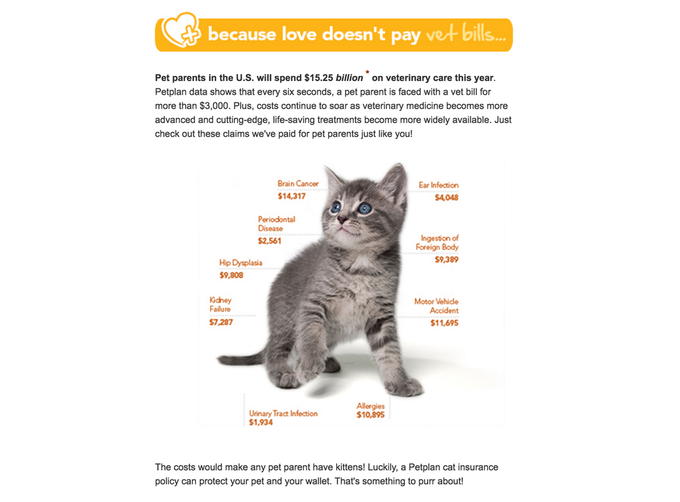

The average salary of a Personal Trainer in the UK and USA are £19,323 and $30,385 respectively a year, When compared to the average salary of £27,000 for all jobs we are earning less than average but we usually serve people with the most disposable income and provide them with the upmost value. Despite our chaotic earning patterns that can have us living like kings one months and struggling the next, as business owners we don’t tend to make the best business decisions when it comes to securing our personal trainer salary. Loss Aversion and the Personal Trainer SalaryImagine you have adopted a kitten and were faced with the decision of whether to purchase pet insurance for your new little friend. Because your cat doesn’t come with family health history, there’s no way to know the likelihood of her having an issue. This uncertainty makes the decision of buying insurance rather difficult: You could save your insurance money and hope for your cat to remain perfectly healthy, but if a health issue were to appear you would possibly need to spend huge amounts of money for treatment. Loss aversion is choosing to purchase insurance (small loss) to avert having to pay out on a huge medical bill later on (big loss). As personal trainers, we tend to struggle with the idea loss aversion due to the larger risk factors that come with an irregular salary. For example, there are many ways we can spend money each month to secure our personal trainer salary and avert bigger costs later on, but most of our income is needed in that moment, there and then, so we don’t. Here’s how to secure your personal trainer salary. Figure Out your Average EarningsTake out a notepad and write down in the top column all of your months of work. In the row below, write down the amount of money that you brought home with you. You’ll probably notice that there is an irregular pattern. For the sake of simplicity let’s say you’ve earned

Using this data, you know that it would be wise to run a promotion in June or July when your income is higher so that you can take on more clients in August when your income is a little lower. Consider offering discounted sessions, cheaper group training, entry-ticket information workshops, etc. before the going gets tough. Find Out if You’re Paying the Best Tax-RateFind a good accountant and have a discussion about potential scenarios for your earnings. In the UK, once you’re making over £25,000 a year it is better to become a Limited Company, rather than Sole Trader. That simple switch saves 9% of tax payments, 9% is A LOT! It’s £1,700 of the average PT yearly salary. You can also choose to register your company from your home, this means that every time you travel to the gym you are making a business trip, something not everyone can say when they’re travelling to work. Putting Your Rates Up and Asking for ReferralsFirst of all, you should be charging what you and your client’s think is a fair price, this is explained in more detail in the Personal Trainer Career Guide under How to Price Your Services. Then, once you have a regular client roster increase your price by at least 2.5%-5% per year, this falls under standard cost-of-living adjustment (COLA). This is a very smooth and small amount for you to ask your clients and it makes a difference to your budget. Plus, it’s way better than waiting 3 years and asking your clients pay an extra £10/session! Let’s say you ask for extra £3 per session and you do on average 25 sessions per week, 48 weeks per year. This small change means extra £3600 a year, a well-deserved holiday with no effort. Every quarter send an e-mail to your clients, saying that you have few spots that are free at the moment, and as a token of appreciation you would like to offer their friends and family having first chance to fill it out. You will never be out of clients. Pay for Income Protection InsuranceOur ancestors didn’t have to worry about retirement or not being able to work. But we have to and the temptation of pay per hour sessions and a regular salary lures personal trainers in to a chain gym or studio. To get the security of a chain gym salary while working in your own business, pay for income protection. Pay for Income Protection is a type of insurance that pay you out your salary for a year or longer, depending on your agreement, in the unlikely event that you can’t go to work. As a self-employed personal trainer this is very important business step to take. Save For TaxSaving for tax is a thing that we all know we have to do but no one does it. It’s like our clients who know what to do but, don’t do it. Again, this comes down to our evolutionary make up and loss aversion. This concept is called hyperbolic discounting, tendency to choose smaller reward now, rather than bigger one later. Going for a night out, every weekend, or not being stressed when we have to pay for the tax later? If I would ask you in advance what is more important, you would say taxes, however, when it comes to Friday night, you may likely justify that clubbing over saving for tax because of a hard week. Know that weakness in yourself and set up automatic payment of 20% from every transaction that comes through your account. You’ll barely miss it. Save for pension via different schemes that are geographically dependent, make it at least your 10% earnings or more. If you’ve got any great tips for securing your personal trainer salary, share with the community below.

|

Our All In One Platform

Check out out all in one business & marketing platform for personal trainers!

WEBSITE BUILDER | FUNNELS |MEMBERSHIPS | SCHEDULING| EMAIL MARKETING| PAYMENTS| CRM | AI ASSISTANT | SURVEYS

Popular Articles

Trusted Partners

We work closely with some of the best service providers in the fitness industry.

Categories

All

|